The economy of Iran was witness to a number of events this week. The new Governor of the Central Bank, Nasser Hemati began work this week and Valiollah Seif handed over the position. Mr. Seif took office when the exchange rate was 3000 tomans per US dollar and left office at 11000 tomans per US dollar. It remains to be seen if the new Governor of the Central Bank can do any better.

This week the Iranian rial was further devalued. The exchange rate changed from 80 thousand rial per US dollar to over 120 thousand rials per US dollar, overnight. After Trump’s tweet offering unconditional negotiations, prices fell slightly to near 110 thousand rials per US dollar. Meanwhile the price of gold continues to rise with the price of gold coins rising to a record breaking 4.4 million tomans which is much higher than the global price of gold. Based on global gold prices, the price of an 8 gram coin is around 314 dollars.

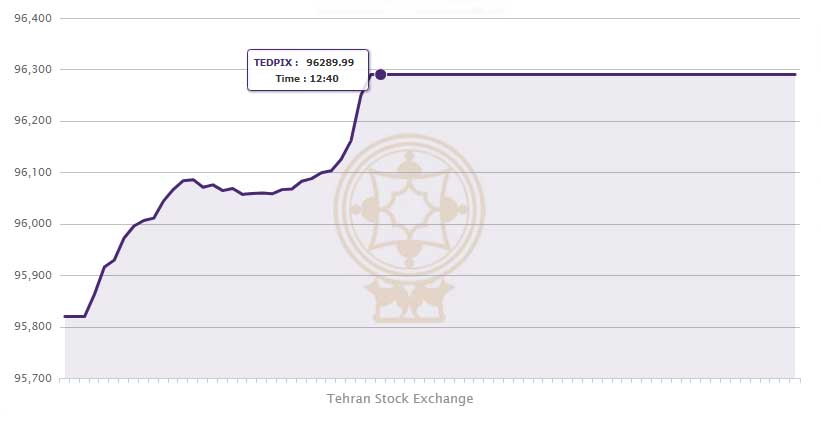

In spite of this instability, Tehran Bourse witnessed significant growth. With pressure to buy shares, the return after one day reached 3.8% which is a historical record in Iran’s capital market and the total return of the week reached 14%. Hopes that all industries will be able to access the secondary currency market, permitting them to trade at the market exchange rate has attracted investors to exporting industries.

Since the stock market in Iran carries a growth and drop limit for the price of shares, some symbols in the metal and mining group as well as the highly traded petrochemical group were stopped due to growths in excess of 20%.