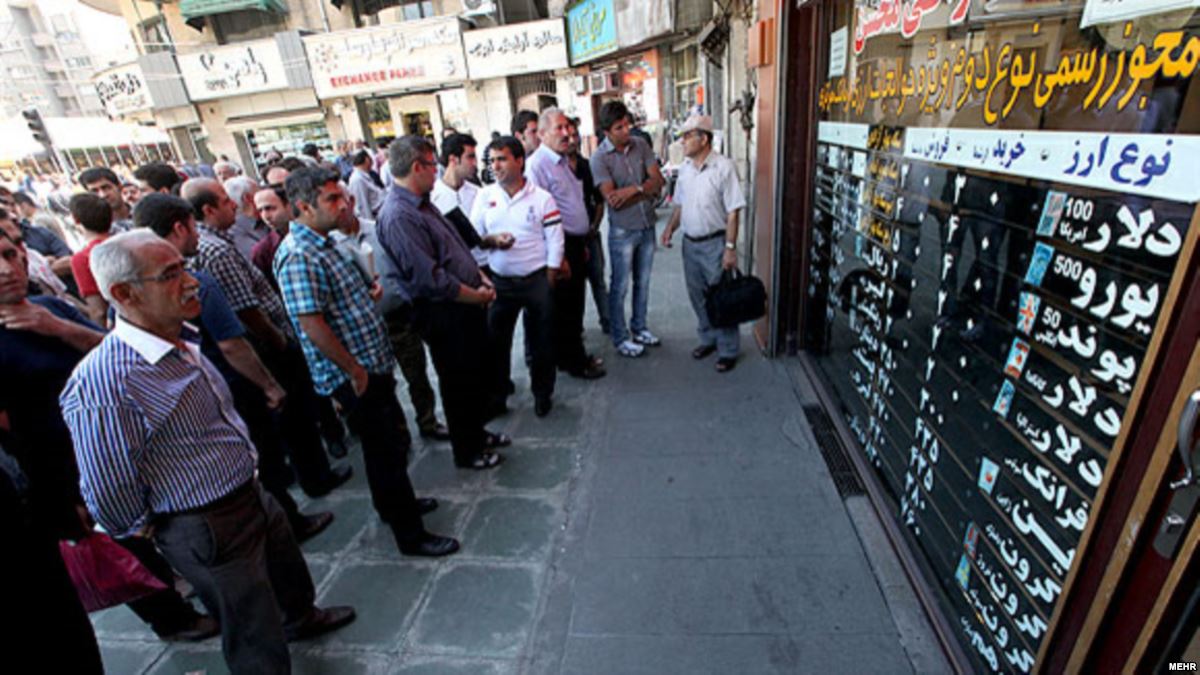

Devaluation of Iranian Rial and the fluctuations in Forex market have become the daily, even hourly, topic. On Tuesday, the Police stopped some foreign currencies’ speculators. The Central Bank of Iran said that every evening when the market has closed and the exchange rate was stabilized, these people made future deals for the next morning on higher prices. This created panic and fastened the devaluation pace. Shahrvand daily reported that 755 bank accounts with a total turnover of 5.9 billion USD related to unofficial exchangers have been blocked. Although some economists argue that such actions would not solve the fundamental problem, but Donyay-e Eghtesad states that according to the Anti-Smuggling of Goods and Currency Act. prohibits the trade of any exchange rate which do not comply the Central Bank of Iran’s rules and therefore the recent arrests are a correct decision.

In order to control the Forex market, The Central Bank of Iran (CBI) introduced a combinatorial investment solutions; for a period of two weeks, it will issue USD or Euro-based Certificate of Deposit with a maturity time of one year and 20 percent yield. In the second offer, banks are allowed to issue USD or Euro-based bonds at the market exchange rate confirmed at SENA Website. Thirdly, the CBI is going to pre-sell gold coins to be delivered within six or twelve months at a price of 14 million IRR and 13 million IRR, respectively. The current price of each gold coin is sold 16 million IRR.