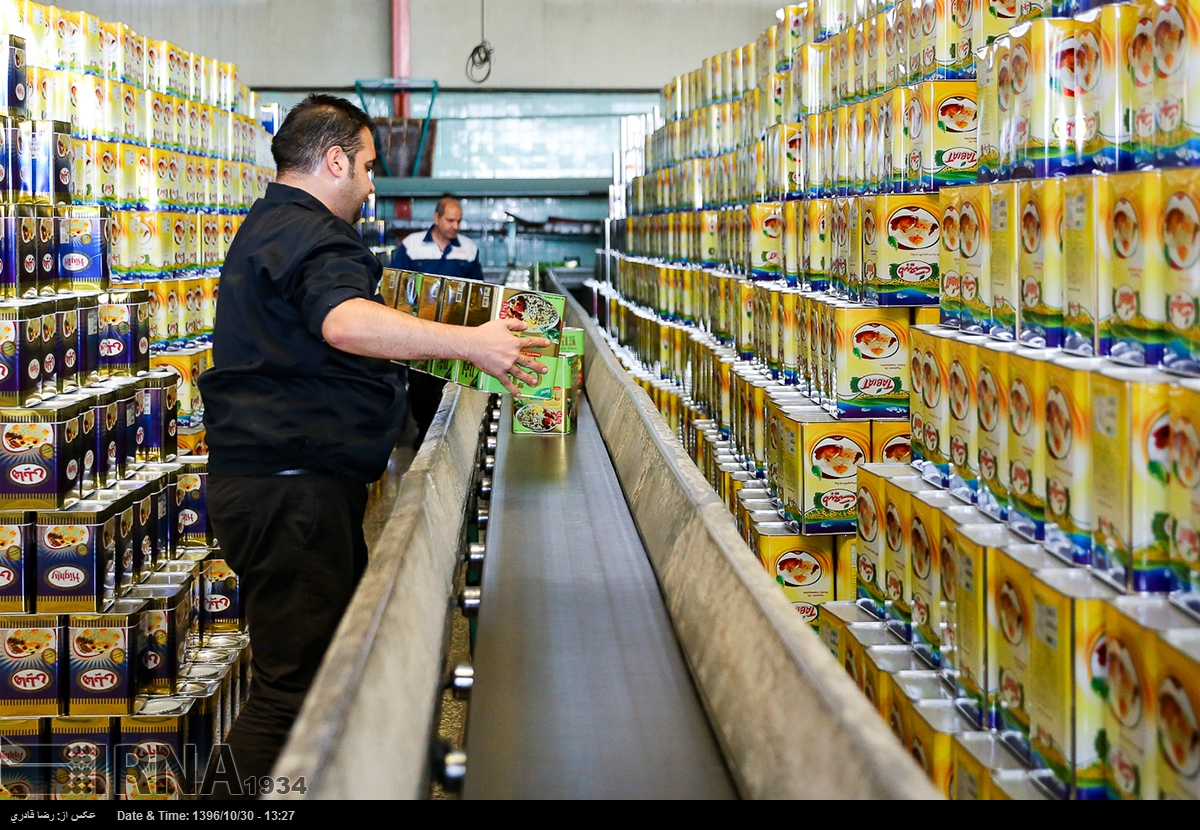

800 tones of cooking oil are blocked at customs since summer 2018 waiting for permissions to be exported, announces the Oil Producers Association of Iran (OPAI).

“From April to June 2018, we succeeded to export 21 million euros of cooking oil to neighboring countries, like Iraq and Afghanistan”, explains Hossein Nikkhah, CEO of Margarin Company and a Board Member of OPAI. “However, in July 2018, suddenly the Ministry of Trade and Industry banned the export of cooking oil. Since then, our production is blocked at customs”.

According to Mr Nikkhah’s explanations, these products can neither be returned to the mainland to be sold at the local market.

But there might be a reason that the Ministry has banned the export of these goods. Although, there is no shortage in cooking oil market in Iran, the local production is heavily dependent on the import of the raw material.

“We import 92% of our raw material import”, admits Mr Nikkhah. “In parallel to the depreciation of Rial, the global prices for raw oil have also increase. We have asked the Government to allow us to increase our prices by 20% to be able to cover our costs. However, until now we have not been granted such increase and therefore we are forced to halt some of our production lines”.

The export of Iron ore concentrate has increased tenfold in the first ten months of the current Iranian years, with respect to the same period a year ago. According to the latest report by Iranian Mines & Mining Industries Development & Renovation (IMIDRO), Iran has exported 5.5 million tons of iron ore concentrate in this period, worth 398 million USD.

The report covers the production at seven main iron ore mines in Iran, namely Jalal-Abad (Kerman Province), Chadormalou (Yazd Province), Sirjan, Markazi, Mishdowan, Chah-Gaz (Kerman) and Sangan (Khorasan).

These seven sites had a total production of 29 million tons of iron ore. Despite the increase in export of concentrate, the iron-ore-fine export has fallen by 77% in the past ten months, dropping to 7.2 thousand tones, worth 203 million USD.

Leather Producers Association of Iran warns about the shortage in procuring the raw material needed to keep workshops alive. Some of the leading leather producers in Iran have joined in sending this warning to the Ministry of Industry and Trade to increase its control on smuggling raw materials, as well as modifying its policies at livestock industry.

Leather industry in Iran has been among the most successful crafts for the country and its independence on the import of raw material has always decreased its risks with respect to exchange rate fluctuations.

However, recently due to the shortage of red meat in Iran, the slaughter of live stock was decreased and the government increased the import of deep-freeze meat. The leather producers, on the other hand, complain that, if instead of importing frozen meat, the government imports live stocks, not only the meat can be used to stabilize the market, the leather and skin can supply the required raw material to their industry.

The smuggling of live stock out of the country is another pain for the leather producers which puts them at a higher risk of not being able to remain in business.