Question: can Tehran Stock Exchange Index influence the Iranian book market directly?

Answer: yes, quite easily.

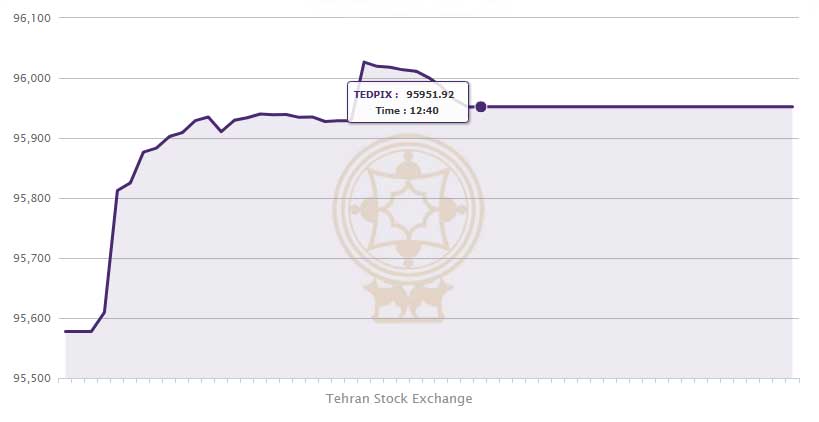

In the past few weeks the sale of books on “capital market and investment” in bookstores has gone up by 70%. The main drive is Tehran Stock Exchange performance which has attracted many people to invest in the stock market in Iran. In the past six weeks, Tehran Stock Exchange Index went up by 104% to break its records one after another.

The continuous growth, pushed several individuals to invest in the stock market who saw few options for profitable investment in the country.

Following the devaluation of Rial, the government tightened the rules on FOREX market and therefore people cannot easily buy foreign cash as much as they want.

Stock market in Iran in the past year has outperformed all other markets such as gold.

“Prices of guide-books on stock market range from 50 thousand Tomans up to 300 thousand Tomans (3 to 20 USD)”, says Abbas, a book seller in Enghelab Square in Tehran.

“During the past weeks, almost every customer coming to our shop, was looking for a guide-book on stock exchange. Most of them are 25 to 45 years old and have a white-collar look. Some buy only one book, however, some of them who look more serious buy up to 4 or 5 books at once”.

The best-seller these days is Technical Analysis of the Financial Market by John Murphy. “In 20 days, I’ve sold 800 copies of that book”, continues Abbas. “Most of the clients want books on technical analysis subjects. They think in this way they can improve their stock market predictions.’’ Abbas thinks his clients are quite wrong.

“There is a common tendency among Iranians, who want to become rich over-night”, says Ali Saeidi, a stock market analyst. “To perform positively, the stock market in Iran, like everywhere else, needs a growing economy and risk a tolerant culture among investors. But we have none of them! Currently Iran’s GDP growth is negative and people have proved not to be risk-tolerant towards economic turbulences. Beside these, they cannot learn proper trading skills by reading books”.

In fact, some surveys show that only 13% of individual investors in Iran have a solid understanding of the stock market mechanism. Many people even cannot distinguish between “investing” or “trading”.

According to Nasser Largani, a member of the Parliament, in the past Iranian fiscal year, 1398, 300 thousand billion Rials of liquidity entered the stock market of Iran. Whereas in the first month of 1399, the liquidity flow toward the stock market was 200 thousand billion Rials, i.e. 76% of the total liquidity of the past year.

Tehran Stock Exchange pulls other markets too

Another flourishing market next to the Iranian book market, is the fever for taking trading courses. One of the largest brokerages in Iran confirms the rising demands for trading courses. Mr Rahimi estimates that within the past couple of weeks the number of registrations for such courses gone up four-folds. These courses, depending on duration, costs between 0.4 to 4.5 million Tomans. Considering that in each course 30 participants are accepted, they can bring 12 to 135 million Tomans per months for each institute.

“The fee for the investment course I’ve registered in is about 3.5 million Tomans”, says Hanie, 32. She is a website developer and has seen several friends of her who have invested in the stock market recently and have gained significantly. “Few months ago, fees for one-month course were around 0.5 million Tomans only. But now that the demand is growing, they have increased their fees as well.” She picks up a book from a shelve at the shop. “The market does not seem to have a bubble. All of my friends’ shares have gone up.” But she cannot hide the worried expression from her face, and adds “at least I hope that it does not have a bubble”.

On Tuesday, after crossing the highest record ever, Tehran Stock Exchange index dropped by nearly 4%. Several amateur investors started to sell their stocks before it drops further and the decreasing trend continued on the last trading day of the week, although at a slower pace.

On Wednesday afternoon, Tehran Stock Exchange index closed the week at 1,017,662 points and TSE market cap reached 38,199,466 Billion Rials ($254.6b).