The government is struggling to control the exchange rate. At the start of the week, and before the unification of exchange rates, the Mercantile Exchange announced that the price of base metals, gold and copper cathode will be set based on the official exchange rate, i.e. the lower rate. With this announcement, Mobarakeh Steel Company, Iran’s largest steel producer witnessed a 3% decrease in its share prices on Saturday. The decision could make the price of domestic steel to be much lower than foreign markets. Consequently, the domestic producers would be uninterested in selling their products in the Iranian market which can lead to serious problems for downstream industries in the country.

After unification of exchange rates, however, the trends have rapidly changed. The export-oriented industries which are positively influenced by higher exchange rates, lost demand, as the official and unofficial exchange rates converged.

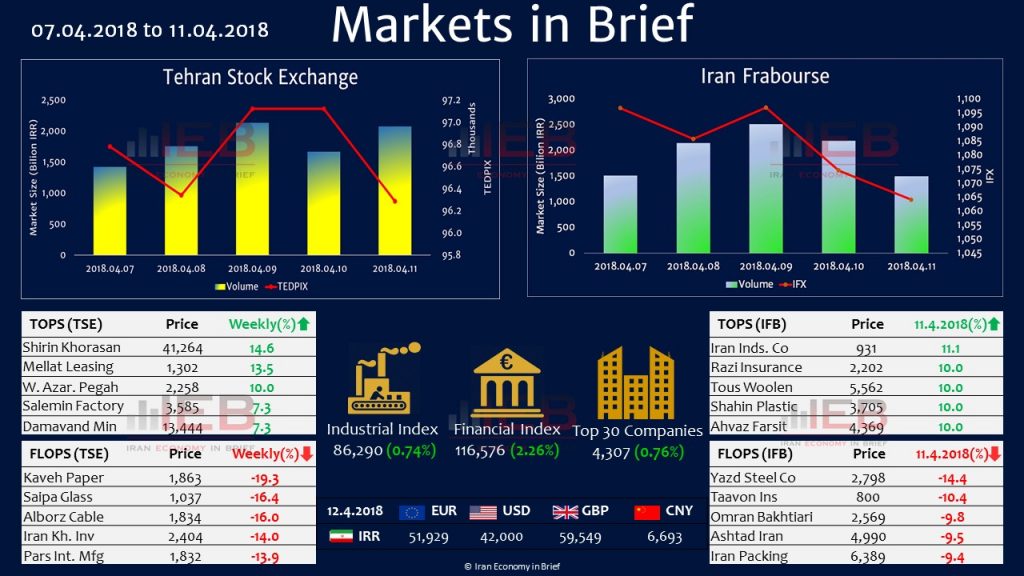

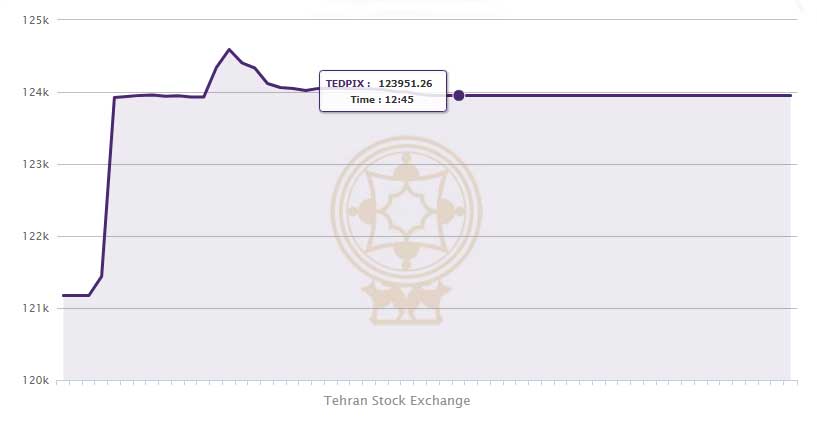

Tehran Stock Exchange and Iran Farabourse (the over-the-counter) both declined this week by 0.82% and 4.4%. At the closer trading time on Wednesday, Tehran Stock Exchange main index, TEPIX, and its market value reached 96,287 points and 91.19 billion USD respectively. See the charts above.