The Minister of Economy presented solutions for making the stock market more attractive and attracting liquidity throughout the country. The latest reports from the Central Bank indicate that by March 2018, liquidity had grown by 22.1% compared to the previous year and reached 15,290 trillion Iranian Rials ($349 billion).

In spite of the growth in liquidity in recent years, the high interest rate from banks led to people investing their money in banks resulting in a stable inflation rate. Iran newspaper writes that since last September, the banking interest rate has been reduced to 15% from 22%. As a result, liquidity has moved to other markets such as foreign currency, gold, real estate and automobiles one after another.

This caused the exchange rate to jump from 30 thousand IRRs per US dollar to upwards of 80 thousand IRRs per US dollar. The price of gold coins also rose from 15 million IRRs to 31 million IRRs.

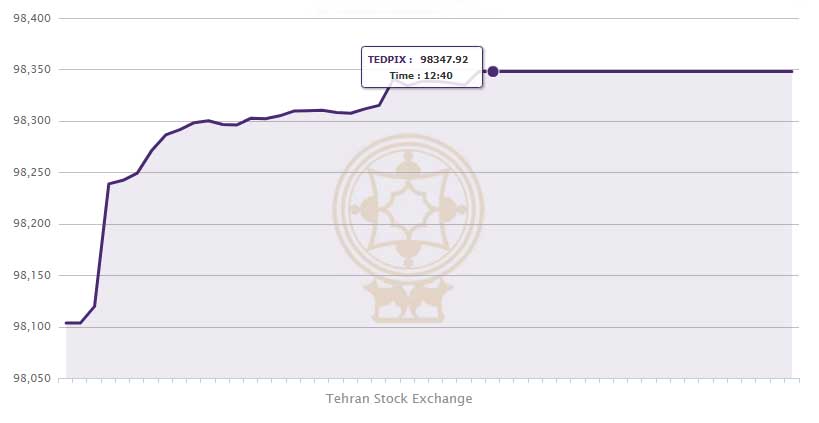

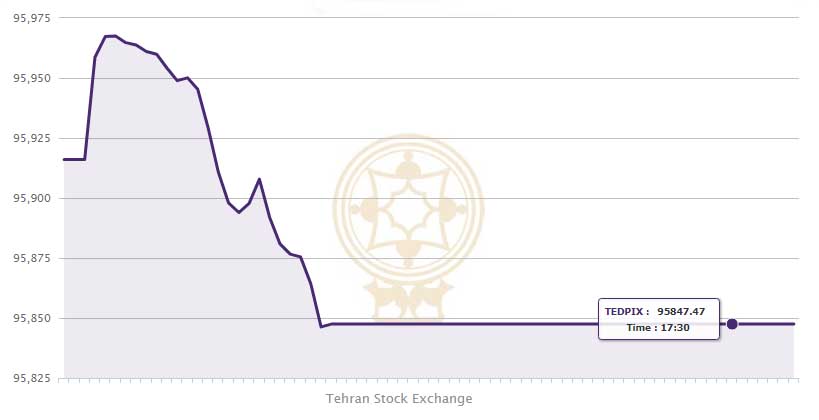

Now, the Ministry of Economics is seeking to make changes at the stock market in order to guide this capital into this market. Some of these incentives are reducing the transfer cost of shares from 0.5% to 0.1% and removing taxes from profits.

However, generally issues such as commission rates are not essential in making the stock market attractive. Rather, numerous issues such as market tools and the profitability of the market are more important factors for attracting investors.