If Iran is determined to get foreign investors in the country, it is essential to offer them a single currency exchange rate.

It is more than five years that the economy is experiencing multiple exchange rates again. With all the effort the Central Bank has put in work, today the gap is 14%.

This difference puts the biggest question in front of foreign investors: which exchange price am I eligible to apply?

The question becomes even more confusing when you may want to deal with a state-owned company or a private one, if the products are considered “strategical” or not.

On the other hand, Iran tries to be recognized as a safe country for investment, but multiple exchange rates are synonyms of an unstable economies.

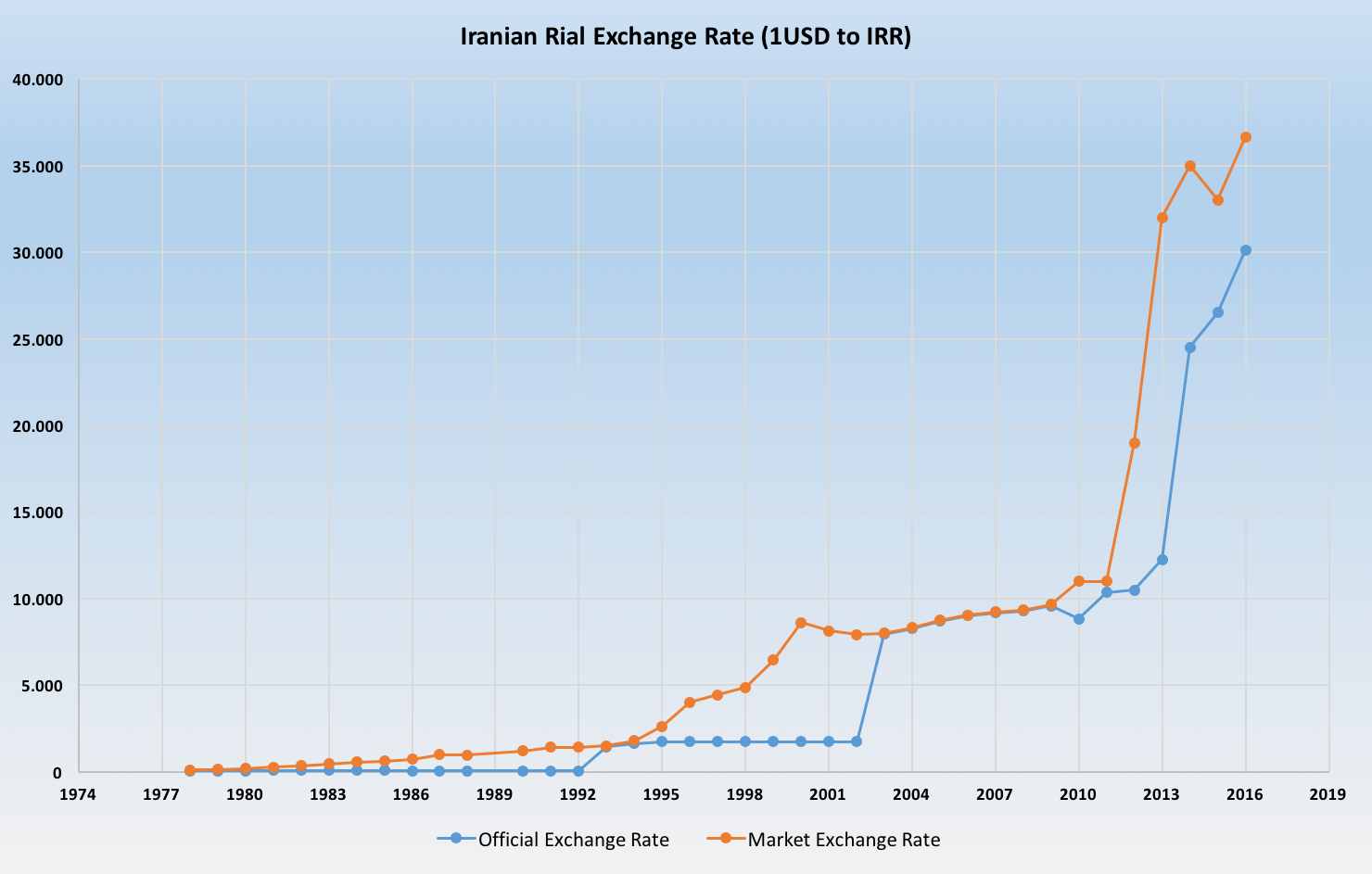

In September 2012, as a result of sanctions, the market exchange price suddenly jumped to 32000 IRR from 19000 IRR.

At this point the gap between the market and official price reached a maximum of 160%.

A year after, in 2014, the Central Bank increased the official exchange rate by 100% to reach 24500 IRR, and in 2015 it was pushed further to 30600 IRR.

Currently 1 USD is equivalent to 30885 IRR and 35104 IRR, officially and at the market rate, respectively.

Thirty years ago, 1 USD was equivalent to 70 IRR and 740 IRR. The largest gap, 2260%, happened two years after Iran-Iraq “peace deal”.

After the Islamic Revolution in 1979, Iranian economy has frequently faced up and down. Obviously the simplest way to cope with it has been applying multiple-tier exchange rates.

However, during the Iranian fiscal years of 1381 to 1387, i.e. March 2002 to 2008, the gap between two rates almost closed; thanks to continues increase in oil price.

Source: Central Bank of Iran