In order to increase liquidity in the stock market, fixed income mutual funds are required to invest at least 5% of their total capital in stocks.

“Mutual funds are required to invest a minimum of 5% and a maximum of 20% of the total value of the fund in stocks, rights issues and stock option contracts in Tehran Bourse, First or Second Market of the Farabourse or a commodity trading certificate accepted in Bourse”, said Dr. Ali Saidi, Deputy Supervisor of Financial Institutions at the Security and Exchange Organization.

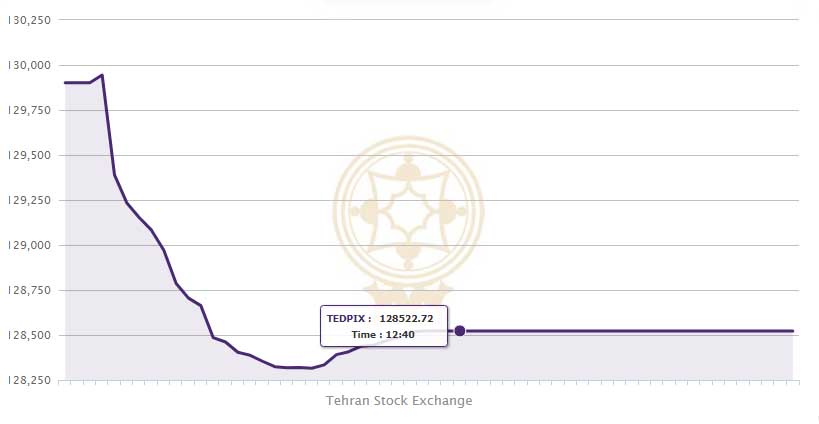

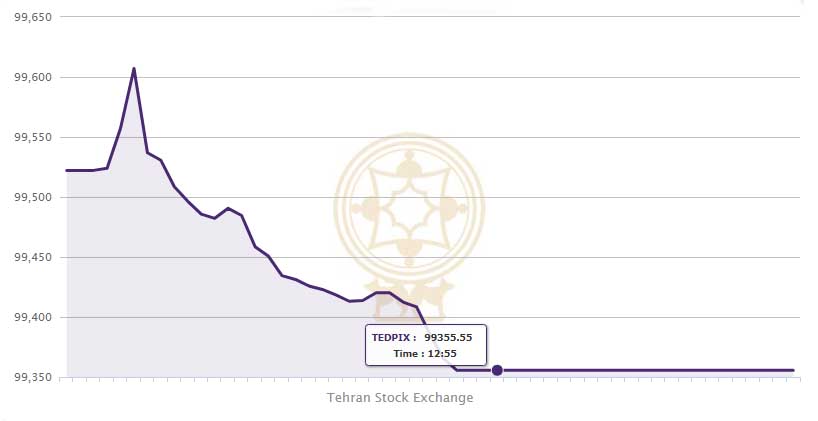

In recent months, a large number of fixed income mutual funds have poured the majority of their holdings into risk-free governmental bonds. On the other hand with the high rate of bank interest in spite of the falling inflation, bank deposits have become another risk free tool for these funds. This has added to the decrease of liquidity in the capital market of Iran.

“In many situations the bond market is used to offset the risk for asset managers and is not the main goal. Furthermore, mutual funds were not created to make bank deposits and no value is added by the investment manager by investing a high percentage of assets in the banking system.

Recently the maximum deposit of mutual funds was reduced to 60% and in the near future will be further reduced to 50%”, added Dr. Saidi.

The SEO is attempting to utilize the resources gathered by asset managers in mutual funds for the benefit of the investment market. It should be noted however that until financial tools such as future contracts and short-selling become available to investors, they are severely limited.